A recent Federal Reserve policy shift has significant implications for mortgage rates, housing affordability, and the broader Utah real estate market. While the headline news focused on a modest cut to the federal funds rate, the more consequential move is the end of quantitative tightening and a change in how the Fed will reinvest principal from its mortgage-backed securities holdings. The result is a subtle reallocation of demand from mortgage securities to Treasury bills that will tend to keep mortgage rates higher even as Treasury yields are supported. For Utah residents, buyers, sellers, and investors, this combination shapes decisions about locking interest rates, pricing homes, and allocating capital in regional markets such as Salt Lake City, Park City, and St. George.

Executive summary: Two moves, different impacts

The Federal Reserve executed two distinct actions that will interact to produce uneven effects across financial markets. First, the Fed reduced the federal funds rate target range modestly to 3.75 percent through 4 percent. On the surface, that appears supportive of lower short-term rates. Second, and more importantly for housing, the Fed announced an end to quantitative tightening effective December 1 and explained how it will reinvest principal payments from agency mortgage-backed securities into Treasury bills rather than replace those agency securities on a like-for-like basis.

Those two moves together mean the Fed will stop shrinking its balance sheet, which stabilizes system-wide liquidity, while changing the composition of the balance sheet in a way that provides support to Treasury yields but reduces demand for mortgage-backed securities over time. The net effect will be relatively lower yields on short-term Treasuries and relatively higher yields on mortgage-related securities compared with an alternative where the Fed kept reinvesting in mortgage-backed securities.

How the Fed’s balance sheet mechanics affect mortgage rates

Understanding the relationship between the central bank’s balance sheet and mortgage rates requires a short primer on bond mechanics. Bonds have an inverse relationship between price and yield. When a large buyer appears in a bond market, prices rise and yields fall. Conversely, when a large buyer withdraws or reduces purchases, selling pressure or reduced demand can push prices down and yields up.

The Federal Reserve's balance sheet is dominated by two asset classes relevant to housing markets: US Treasuries and agency mortgage-backed securities. When the Fed buys agency mortgage-backed securities, it increases demand for those securities, which supports their prices and suppresses mortgage rates. When the Fed reduces its holdings of mortgage-backed securities, the opposite pressure arises: mortgage-backed securities receive less buying support, prices weaken, and mortgage yields rise, all else equal.

By choosing to allow mortgage-backed securities principal to roll off but reinvesting those principal payments into Treasury bills, the Fed is structurally shifting demand away from mortgage-backed securities over time. Treasury bills receive incremental support while mortgage-backed security demand diminishes. The practical consequence is higher mortgage rates than would otherwise be the case and relatively lower yields on short-term Treasuries.

Why this is effectively stealth quantitative easing for the government

Quantitative easing usually refers to the central bank expanding its balance sheet to buy assets and provide liquidity. Although the Fed is not explicitly restarting QE by increasing the size of its balance sheet, the reinvestment policy acts as a backdoor support for government borrowing costs. By rolling mortgage principal into Treasury bills, the Fed is increasing demand for government debt instruments and helping to keep Treasury yields lower than they would be in a pure market-clearing scenario.

For the federal government, lower yields on Treasury instruments mean cheaper financing for deficits. That outcome benefits fiscal policy priorities but comes at the cost of a weaker support mechanism for housing finance. Mortgage rates are partly determined in secondary mortgage markets where investor appetite for agency mortgage-backed securities matters. Reducing that appetite through passive portfolio reallocation transfers some of the interest-rate relief away from homeowners and prospective buyers and toward the Treasury.

Why the Fed stopped quantitative tightening and why that matters for Utah

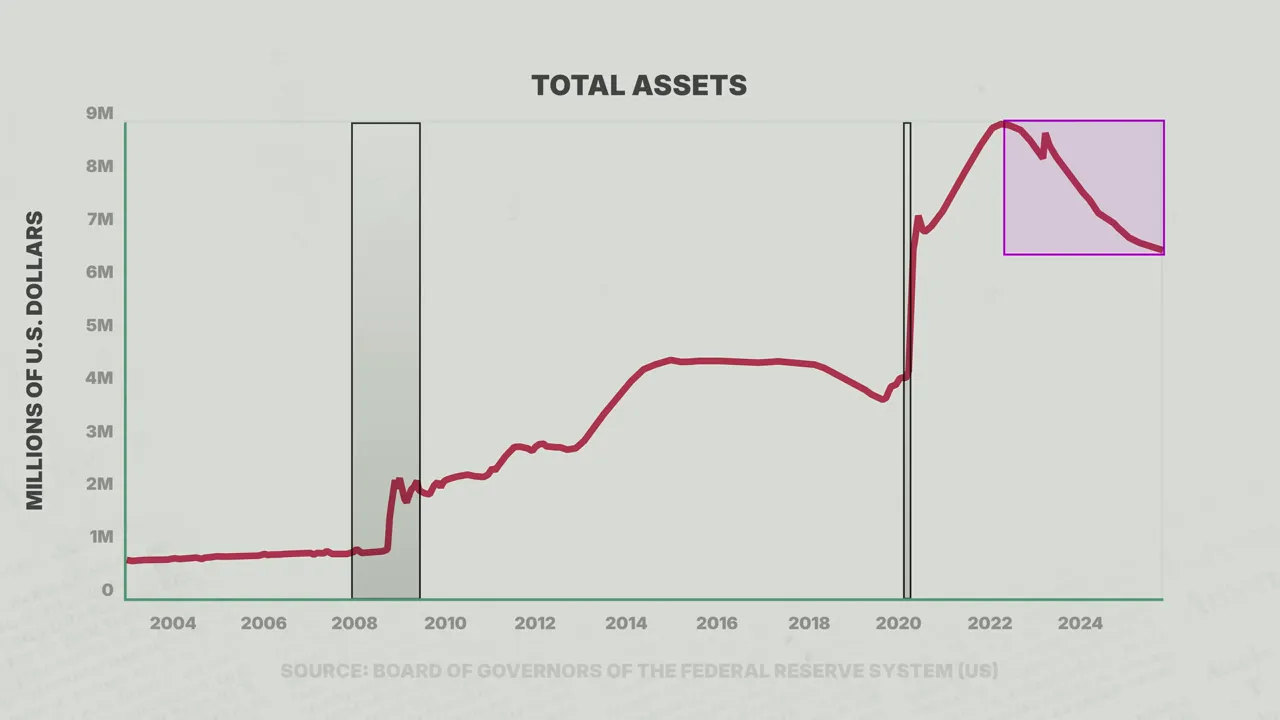

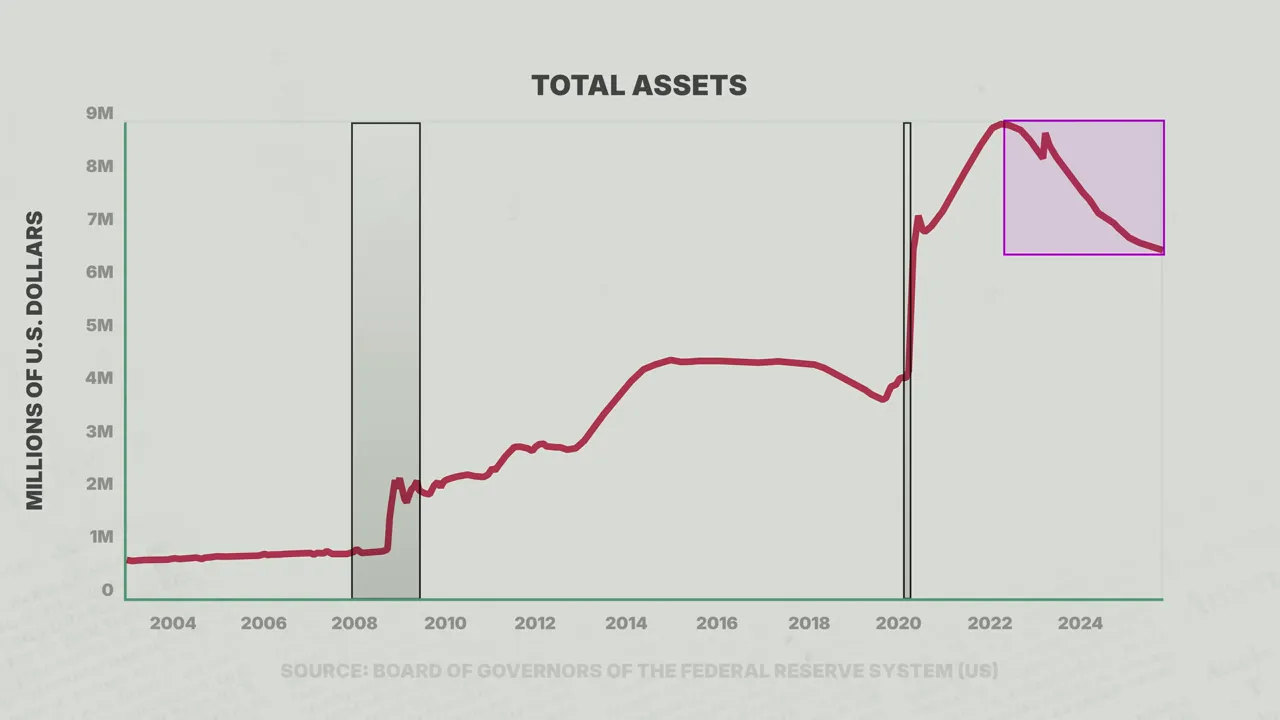

Quantitative tightening, or QT, was the process by which the Fed allowed maturing securities to roll off the balance sheet without reinvesting proceeds, effectively withdrawing liquidity from the financial system. Since April 2022, the Fed's balance sheet shrank noticeably—from a peak of roughly nine trillion to near six and a half trillion—reducing liquidity by about two and a half trillion dollars. That withdrawal had direct effects on rates, asset prices, and market functioning.

Explore Utah Real Estate

83 W 850 S, Centerville, UT

$815,000

Bedrooms: 5 Bathrooms: 3 Square feet: 3,999 sqft

653 E RYEGRASS DR #305, Eagle Mountain, UT

$387,900

Bedrooms: 3 Bathrooms: 3 Square feet: 1,985 sqft

2098 E GOOSE RANCH RD, Vernal, UT

$103,000

Square feet: 274,864 sqft

Recent strains in short-term funding markets, including pressures in the reverse repo and bank reserve systems, prompted caution. The Fed’s decision to stop QT on December 1 signals a pragmatic approach: avoid tightening liquidity further in an environment where funding stress could re-emerge. For the Utah real estate market, the immediate result is stability in overall liquidity conditions, which matters for mortgage availability, bank lending capacity, and local credit flows to homebuyers and property investors.

How the reinvestment policy sacrifices housing to backstop Treasury yields

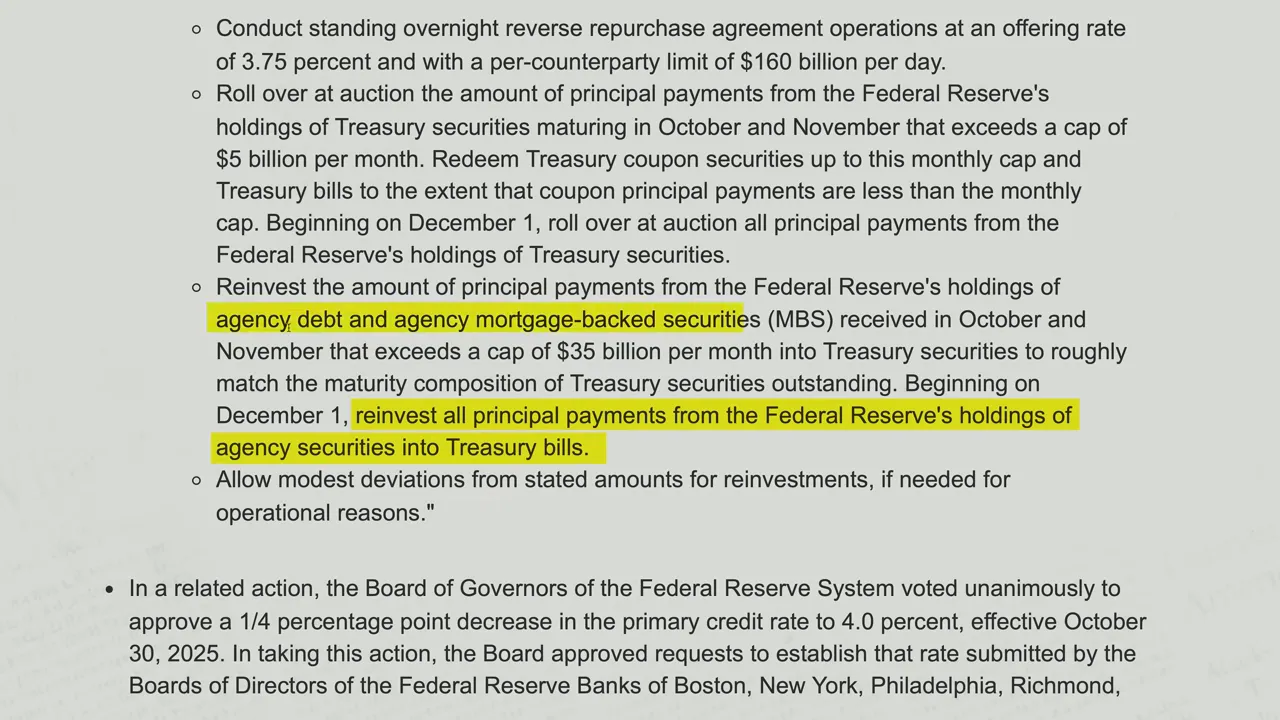

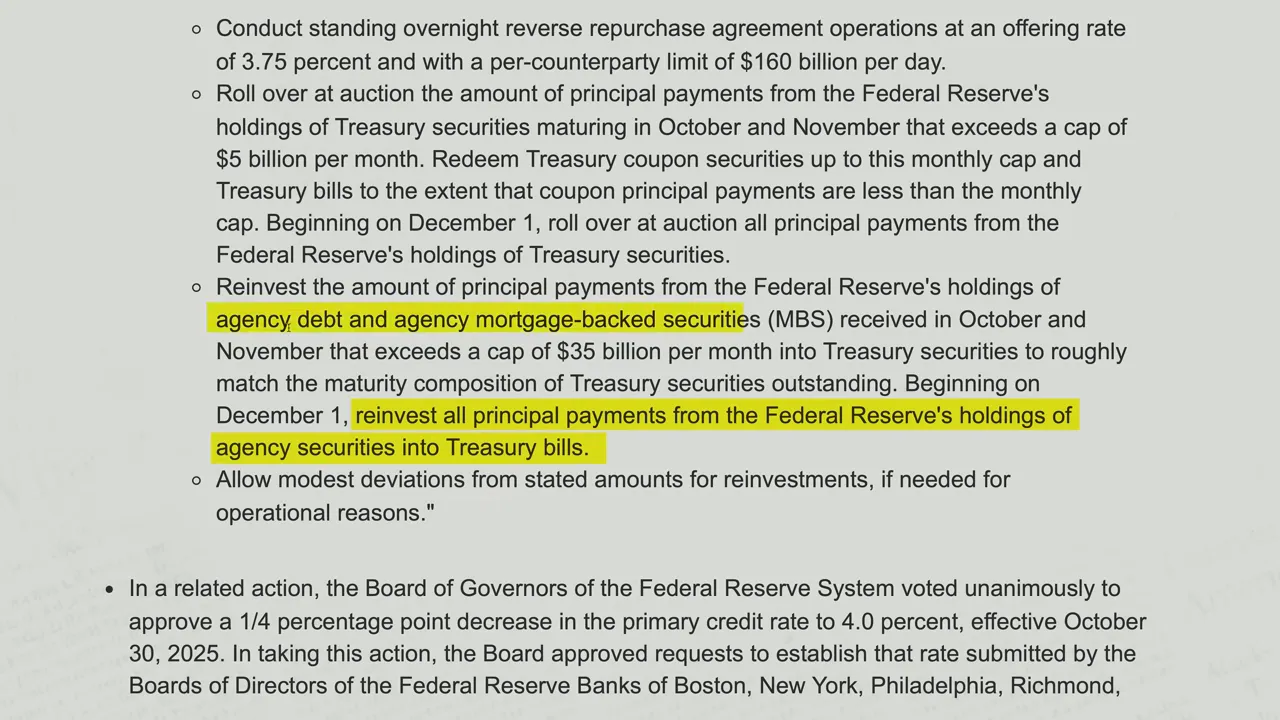

Beginning December 1, the Fed will roll over all principal payments from Treasury securities into similar Treasury instruments at auction. Simultaneously, it will reinvest principal payments from agency securities into Treasury bills rather than into new agency mortgage-backed securities. That divergence is the key policy tilt.

Because mortgage-backed securities will be allowed to shrink in the Fed’s portfolio while Treasuries are replaced, the Fed implicitly chooses to support government borrowing costs over mortgage rates. The mortgage market will continue to feel downward buying pressure from the absence of Fed reinvestment, which translates into upward pressure on mortgage rates. Treasury bills, instead, will benefit from the Fed’s reinvestment activity and will likely see yields stay lower than they otherwise would.

What this looks like in practice for Utah buyers and sellers

The local implications are practical and immediate. Mortgage rates are a crucial component of monthly payment calculations, pricing decisions, and affordability. Even modest differences in mortgage yields can alter the pool of buyers able to qualify for traditional conforming loans, affect resale values, and shape decisions about whether to rent or buy.

Buyers: Prospective homebuyers in Utah face the prospect of mortgage rates that remain elevated relative to the expectations many held earlier in the year. For buyers with flexible timing, the options include locking a mortgage rate if the current level is acceptable, exploring adjustable-rate mortgages with clear caps and reset features, and considering short-term Treasury-linked products or buy-downs where available. Additionally, buyers should evaluate housing affordability with stress testing for higher rates and rising living costs, given the Fed’s tilt toward keeping Treasuries cheap at the expense of mortgage support.

Sellers: Sellers in fast-growing Utah markets should calibrate asking prices to reflect the constrained buyer pool created by higher mortgage costs. A listing price that assumed a significantly lower mortgage rate may be unrealistic if the buyer market cannot access sufficient financing. Sellers can reduce time on market by making targeted improvements, offering seller-paid rate buydowns where feasible, or structuring creative seller financing in limited cases to bridge affordability gaps.

Investors: For investors, the policy environment raises the relative attractiveness of rental investments, at least in the near to medium term. Higher mortgage rates squeeze homebuying demand, bolstering rental demand and potentially supporting rents in supply-constrained Utah cities. Investors should analyze cap rate compression, local rent growth fundamentals, vacancy trends, and regulatory considerations across city markets such as Salt Lake City, Park City, St. George, and others. Due diligence must include sensitivity analyses for financing cost movements because higher rates can significantly compress cash-on-cash returns.

Regional examples and tactical guidance

Salt Lake City: As Utah’s economic hub, Salt Lake City benefits from strong job growth and in-migration trends. Those demand drivers can offset some affordability pressures, but elevated mortgage rates will widen the gap between effective demand and list prices in the entry-level segment. Buyers may find that securing concessions, such as closing-cost assistance or temporary buydowns, helps bridge the affordability gap.

Park City: High-end second-home markets like Park City face different dynamics. Buyers here are often less rate-sensitive and more driven by lifestyle and investment considerations. However, financing costs still matter for leveraged purchases, and investors should price deals assuming sustained rate volatility. Sellers in Park City should emphasize non-rate benefits of ownership, such as tax considerations, rental income potential during peak seasons, and scarcity value.

More Properties You Might Like

2148 E GOOSE RANCH RD, Vernal, UT

$116,000

Square feet: 309,276 sqft

6668 S 3200 W, Spanish Fork, UT

$2,074,000

Bedrooms: 3 Bathrooms: 3 Square feet: 2,560 sqft

2031 N LAVA ROCK CIR #107, St George, UT

$4,185,000

Bedrooms: 4 Bathrooms: 5 Square feet: 5,404 sqft

St. George and southern Utah: Rapid population growth and relative affordability compared with Wasatch Front cities support persistent demand in places like St. George. Supply constraints and migration trends may keep home values resilient even as mortgage rates remain elevated. Investors focused on single-family rentals should weigh supply pipeline factors, construction cost pressures, and local amenity growth when underwriting deals.

Local renovation and resale strategies can help sellers and investors optimize outcomes in this environment. Energy efficiency upgrades, modest kitchen and bathroom remodels, and curb appeal investments often produce outsized effects on buyer perception and resale value. Investors should also consider property types and neighborhoods that historically maintain stable rents and occupancy during rate cycles.

Practical mortgage strategies for Utah buyers

- Rate locks and float-downs: When mortgage rates are elevated and expected to be volatile, locking a rate can protect buyers during the escrow period. Some loan products offer float-down options that allow a rate adjustment if rates fall after the lock; the cost and availability of float-downs should be evaluated carefully.

- Adjustable-rate mortgages: ARMs can be appropriate for buyers expecting to refinance within a few years or those planning short holding periods. ARMs generally start with lower initial rates than fixed-rate equivalents, but caps and reset structures must be understood to avoid unpleasant surprises.

- Seller concessions and rate buydowns: In a market where the Fed’s policy keeps mortgage support limited, seller-paid buydowns or temporary interest-rate subsidies can widen the buyer pool. Sellers with room to negotiate on price or closing costs can use these tools to attract buyers.

- Down payment optimization: Larger down payments reduce loan-to-value ratios and often lead to better pricing from lenders. Buyers should evaluate whether a slightly higher down payment makes a material difference in monthly payments and qualifying ability.

- Nonconforming and portfolio lending: For buyers who do not fit typical conforming loan profiles, portfolio lenders and nonconforming products may offer flexibility. These options often come with higher rates but can be powerful tools for investors or buyers with complex incomes.

What this means for Utah market fundamentals and long-term investors

Long-term investors should focus on fundamentals. Utah remains one of the faster-growing states in the nation, drawing talent and population due to strong labor markets, quality of life, and outdoor recreation assets. Those demographic drivers support housing demand over multi-year horizons. At the same time, monetary policy choices that prioritize Treasury yields over mortgage support inject additional rate risk into housing investments and can elongate any period of affordability pressure.

Investors should adopt conservative underwriting assumptions, stress test for elevated financing costs, and prioritize markets where supply constraints, strong rental demand, and employment diversity provide downside protection. In many Utah submarkets, value-add strategies—such as targeted renovations and operational efficiencies—can outperform speculative bets on rapid appreciation when macro policy remains uncertain.

Policy context: Why the Fed’s choice reflects broader fiscal dynamics

The Fed’s reinvestment choice cannot be divorced from fiscal realities. Over decades, government borrowing trends and the broader debt cycle have changed. Between long-term disinflationary trends and recent inflationary spikes, policy responses have shifted. Central bank tools are increasingly deployed in service of stabilizing borrowing costs for the government, which affects where liquidity is directed. The Fed’s decision to route agency principal into Treasury bills is consistent with a broader dynamic where finance and fiscal policy intersect, creating winners and losers across asset classes.

For homeowners and prospective buyers, the implication is less favorable: mortality of generous rate relief is higher, and housing affordability is likely to erode unless counteracted by supply growth or fiscal policy changes targeted at housing.

Data sources and additional context

Readers seeking primary source details can consult the Federal Reserve’s public press release and implementation notes for the full technical language on reinvestment policy. For regional demographic context, the U.S. Census Bureau provides population and migration data that explain why Utah’s housing demand remains structurally strong even as mortgage affordability weakens. Associations such as nar.realtor publish periodic housing market statistics that can assist with local comparisons and trend analysis.

For local Utah property listings and market connections, the resource https://bestutahrealestate.com provides a searchable portal with current inventory, price trends, and local agent resources tailored to northern and southern Utah markets.

Scenario narrative: How a Utah family might navigate this landscape

When the Smiths decided to relocate to a suburban community near Salt Lake City, they entered a market facing higher mortgage rates than just a year prior. Their monthly budget remained tight, and initial offers based on older rate assumptions failed to get traction. By choosing an adjustable-rate mortgage with a near-term fixed period, pairing it with a modest down payment increase, and negotiating a seller-paid buydown for the first year of payments, the Smiths bridged the affordability gap. Their case is illustrative: in a period where the Fed favors Treasury yields, creative financing, realistic pricing, and careful renovation planning can enable successful home purchases in Utah without relying on broad-based declines in mortgage rates.

Action checklist for Utah market participants

- Buyers: get prequalified with multiple lenders, compare fixed and ARM options, and consider rate locks when contracts go under agreement.

- Sellers: price to the current financing environment, consider seller concessions, and invest in high-impact renovations that justify price points.

- Investors: underwrite with conservative rate assumptions, prioritize cash flow and rent growth-supported deals, and evaluate supply constraints for long-term stability.

- Professionals: lenders and brokers should stress-test borrower capacity at higher rates, and local municipalities should prioritize policies that increase housing supply to mitigate affordability pressures.

Limitations and things to watch

The Fed’s balance sheet reinvestment policy will change portfolio composition gradually rather than overnight. The scale of reinvestments relative to global capital markets means the movement will not spike immediate, dramatic changes in national yields. Nevertheless, small persistent tilts can alter relative pricing across asset classes and influence mortgage rate trajectories over months. Market participants should watch Treasury bill yields, agency mortgage-backed security spreads, and bank lending behavior for signals that the reinvestment policy is beginning to shift financing conditions materially.

Conclusion

The recent policy choices create a subtle but meaningful divergence between support for government borrowing costs and support for mortgage markets. For Utah’s housing market participants, the implications are clear: affordability pressures are likely to remain unless supply responds or external macro conditions shift. Buyers, sellers, and investors should adopt practical strategies—such as locking appropriate financing, using creative concessions, and underwiring investments conservatively—to navigate a landscape in which the Fed stabilizes liquidity but changes the composition of its holdings in a way that favors Treasury yields over mortgage support.

Frequently Asked Questions

How will the Fed’s reinvestment policy affect mortgage rates specifically in Utah?

Reinvesting principal from mortgage-backed securities into Treasury bills reduces net demand for mortgage-related securities. This relative decline in demand for mortgage-backed securities places upward pressure on mortgage yields over time, which translates into higher mortgage rates for Utah homebuyers compared with a scenario where the Fed continued reinvesting directly into mortgage-backed securities. The magnitude will be gradual, but even modest increases in mortgage rates can affect affordability and buyer qualification thresholds in local Utah markets.

Should Utah buyers wait for mortgage rates to drop before purchasing?

Waiting can be risky because rates may remain elevated for an extended period given the Fed's preference to support Treasury yields. Buyers should evaluate personal timelines, rent versus buy affordability, and local market competition. For buyers who anticipate short-term relocation or have tight affordability windows, locking a mortgage rate or considering rate buydowns and adjustable-rate products may be more practical than waiting for an uncertain decline in rates.

What strategies can Utah sellers use to attract buyers when mortgage rates are high?

Sellers can make targeted, cost-effective improvements that increase buyer appeal, offer temporary rate buydowns or closing-cost assistance, and price listings in line with current financing realities. In higher-price segments, emphasizing non-rate benefits such as rental income potential, scarcity, or lifestyle attributes can maintain buyer interest despite rate headwinds.

How should real estate investors adjust underwriting in this environment?

Investors should use conservative financing assumptions, stress-test returns across a range of interest-rate scenarios, prioritize cash-on-cash returns and rent-supported models, and focus on markets with strong supply constraints and consistent job growth. Hedging interest rate exposure, staggering loan maturities, and maintaining liquidity reserves are prudent measures in a period of policy-driven rate uncertainty.

Where can Utah residents find reliable local housing inventory and market resources?

Local inventory and market data can be accessed through regional listing portals and resources such as https://bestutahrealestate.com. For authoritative statistics and demographic context, government and industry sources like census.gov and nar.realtor provide helpful datasets and trend reports.